This past semester, I took Frank Rothaermel’s “Strategic Management” class as part of Georgia Tech’s Executive MBA program. One of the highlights of the class was splitting up into teams and doing an Oxford-style debate with each team taking an opposing position to a question. Our team’s question was “Should Tesla release Elon Musk as CEO?” and our position was yes, they should. The topics and positions were assigned; we didn’t have a choice.

Elon’s been in the news a lot lately, most recently because he decided to buy Twitter, or perhaps most most recently when he indicated that maybe he’s not so sure he wants to buy Twitter. He can’t seem to make up his mind. We thought about this kind of stuff a lot when preparing for our debate presentation about why Elon shouldn’t be the CEO of Tesla. Today’s essay is based on the research I did to prepare for our team’s debate.

Let’s be clear from the start: Tesla is the dominant electric vehicle (EV) manufacturer globally. If you were to try to make the case that Elon should not be CEO of Tesla because Tesla isn’t very good at making electric vehicles, you would fail. Take a look at global EV sales from last year:

Even when we look at Tesla’s own internal numbers, they’re clearly demonstrating outstanding growth. Good job Elon:

Tesla’s clearly winning, by both external and internal standards. But where are electric vehicles on the technology adoption curve?

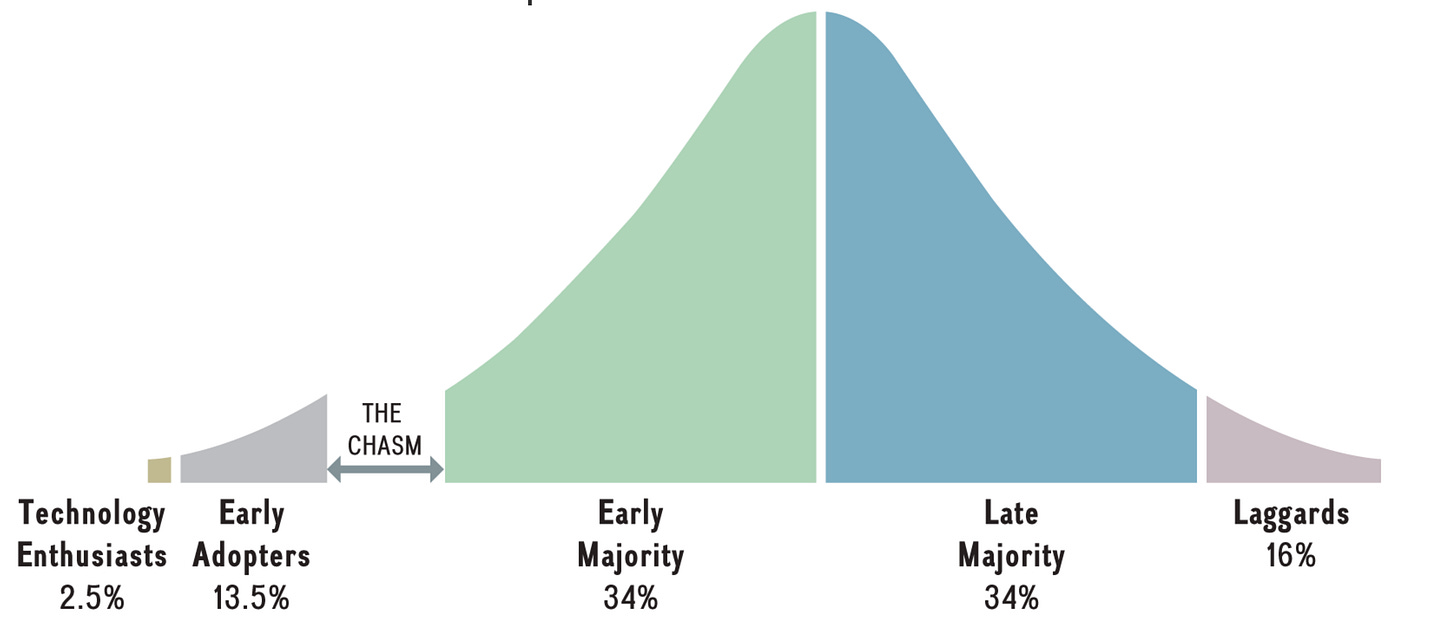

Tesla’s growth numbers and even their vehicle deliveries compared to competitors don’t give us enough data to tell us where we are on the adoption curve. Consumers have different needs at different parts of the adoption curve. What works for the technology enthusiasts isn’t going to work for the early majority.

Let’s look at global auto sales numbers for the past several years:

Global automobile sales have been above 80 million vehicles per year for the past several years (2020 notwithstanding). How much of the market is represented by EV sales?

Although EV sales have indeed been growing, they represent only 4% of global automobile sales annually. We’ll be in the late 2020s before EVs have 20% of market share:

If EV share of sales is only 4%, where does that tell us about where we are on the adoption curve?

Keep in mind we’re not describing where Tesla is on the adoption curve. We’re describing where the entire electric vehicle market is on the adoption curve. Because electric vehicles (at scale) are a relatively new technology that is replacing an existing technology, it will take time for electric vehicles to penetrate the automobile market.

When a market for a new technology is emerging, the first consumers are the technology enthusiasts. The original Tesla Roadster is a good example of making an EV which appealed to technology enthusiasts. The Roadster wasn’t entirely practical as a commuter car, but it was fun to drive and it proved that EVs were a viable technology1.

As the market and related technology matures, it begins to appeal to a different type of consumer. The early adopters want some level of practicality but are willing to make considerable trade-offs to bring the new technology into their lives. The Tesla Model S can be seen as an appeal to the early adopters. At its introduction, it was a practical luxury commuter car, even before the Supercharger network had been built out.

While Tesla’s later vehicles, especially Model 3 and Model Y, feel like they’re appealing to an early majority, they live in a market that’s still very clearly in the early adopter phase. Perhaps they’ll continue to appeal to the early majority as the market matures, but success isn’t guaranteed.

There’s a chasm ahead

The introduction of the early majority represents the greatest opportunity in the evolution of a market. While the technology enthusiasts and early adopters represent 2.5% and 13.5%, respectively, of the market, the early majority represent 34% of the market. The challenge for businesses is that the needs and preferences of the early majority are much different than the preferences of the technology enthusiasts and early adopters. Success in an earlier segment doesn’t guarantee success in later segments.

Businesses that fail to adapt risk falling into the chasm that separates the early adopters from the early majority.

Let’s go back in time to December 2006 and look at smartphone market share by operating system in the United States:

If you can remember back to 2006, you’ll recall that Palm, Symbian, Microsoft, and BlackBerry all dominated the smartphone market. What happened in 2007?

The iPhone.

Once the iPhone—and later, Android—entered the market, the dominant market players from the prior era of smartphones faded into obscurity. You can even plot smartphone adoption on the technology adoption curve:

If you had asked Steve Ballmer and the editors of most gadget blogs in 2006 who would emerge as the dominant players in the smartphone market, I don’t think very many of them would have said Apple and Google. They weren’t even on the map at the time. But the current market was serving only technology enthusiasts and barely beginning to serve the early adopters.

The majority of people weren’t interested in smartphones because early smartphones weren’t built for them—early smartphones were built for the technology enthusiasts. When Apple introduced the iPhone, a new type of consumer emerged that said, “yes, here’s a smartphone that’s made for me.”

Elon and Tesla’s chasm

There’s no doubt that Elon Musk has been a large part of Tesla’s success as an emerging automotive brand, or even just a global brand. However, the EV market is still very young and has only recently begun to appeal to early adopters. Based on what we know about technology adoption, we shouldn’t expect that what’s worked for EV manufacturers in the past will continue to work in the future.

As of today, Elon Musk is synonymous with the Tesla brand. Will tomorrow’s electric vehicle consumers want to buy Elon Musk, or will they want to buy Ford, Lexus, and Audi?

Tesla is going to need a CEO who can singularly focus on leading the company across the chasm. That CEO is not Elon Musk.